The Ugly Truth About Austin Real Estate

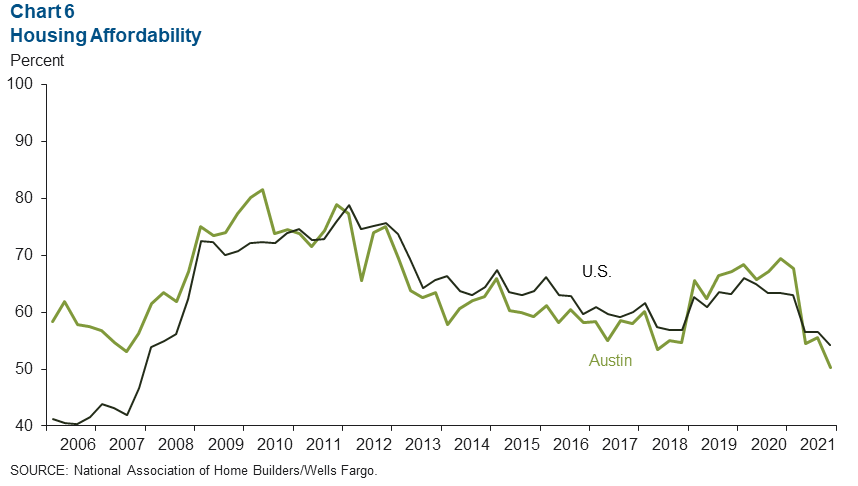

As much as I’d love for everyone to be able to afford a home, the ugly truth is that average people are decreasingly able to afford a home in Austin.

The numbers are shocking! Median home prices have dramatically outpaced median income. This is bad news! Some look at the widening spread and conclude that Austin real estate is overvalued and due for a correction. Like a law of nature, they think the median person will always be able to afford an average home, but I don’t remember that being one of Newton’s laws.

Owning a home gives you the opportunity to build equity. This is an opportunity you don’t want to miss out on! The average homeowner has a net worth 40x greater than the average renter. Once home ownership is out of reach, it continually gets harder to save up enough for a down payment.

It’s like chasing a helium balloon up a mountain — your legs start getting tired, there is less and less oxygen and the balloon continually gets farther ahead. For most people this looks like lifestyle creep, then you have a kid, then you need daycare, and eventually aging parents.

Most people can only afford their 2nd home because they take the equity they built up from their starter home. Here’s how this works: Each month homeowners pay their mortgage — aka building equity — over time the home appreciates — aka building equity. Time to sell?

American tax law incentivizes people to upgrade their homes. To do that, they let people take $250,000 in tax-free profit from the sale of their first home, which makes it easier to buy a second home. If you’re married, the number doubles to $500,000.

What happens when the median person can no longer afford a home?

For answers, let’s talk supply and demand… If there are more high-income people in Austin willing to pay higher prices and not enough new homes being built, average people won’t be able to afford a home. In response, they move to less expensive areas, which partially explains why the two Austin suburbs, Leander and Georgetown, are the two fastest-growing cities in America.

Why Home Prices Will Keep Rising

Austin is the strongest economy in the world. It has a dynamic economic base with tech, a robust healthcare network, a thriving university, and if Texas was a country, it’d be the 10th largest economy in the world (ahead of South Korea and Canada). This magnetic force is created by two factors: an educated workforce and job growth.

1. Educated Workforce

There are more college students in a 100-mile radius than any other US city, with roughly 400,000. Naturally when looking for jobs and places to live they’ll be attracted to nearby cultural hubs with lots of opportunities — jobs, dating, restaurants, paddleboarding, music festivals, improv shows, and America’s best public swimming pool.

I was a recent college graduate and looked around the country for a city that had a warm climate, lots of young educated people, tons to do, and a reasonable cost of living. All of those are still true, although the cost of living is relative. If your other options are New York City, San Francisco, or Seattle, then Austin is still the clear winner and will be for at least the next five years.

2. Job Growth

Companies looking for an educated workforce see this trend and start moving jobs to the area. Especially when those jobs are currently in areas where it’s more expensive to employ the same person (Silicon Valley, Los Angeles, New York City, Boston).

I remember thinking in 2018 when Apple announced they are going to build a $1B campus “wow, well that’s the biggest announcement we’ll hear for the next decade.” Boy, was I wrong.

I underestimated how momentum works. People see that there are more jobs and opportunities in Austin with all the companies moving here so they want to move. It creates a cyclical momentum, more jobs = more people. In a tight job market where it’s hard to hire talent, companies then move more jobs to where the people are, and so on.

Seven years ago, I remember talking to a woman decked out in Lululemon gear who said “I can’t move to Austin, you don’t have an Equinox.” Now there’s a snazzy Equinox in town and I just saw Lulu Lady on the elliptical.

Since Apple’s 10-figure announcement, we’ve had Oracle move their HQ to Austin, TikTok leased half a building, Google built one of the most impressive buildings downtown, Army Futures Command came, Indeed built a huge tower, Facebook leased several buildings, Samsung announced a $17B Semiconductor plant (corporate jet consistently spotted parked at Bergstrom Airport), and Amazon’s new fulfillment center in Pflugerville is so big that you could probably land a 747 on the roof. Oh, and the largest computer manufacturer in the US, Dell, is still Austin based. As a tech hub, Austin attracts twice as many venture capital dollars than every other Texas city combined.

Those are just the big names, there are lots of vendors to these companies that need to now have a presence here and all the smaller companies that don’t get big announcements.

Conclusion

The cycle of job growth and educated workforce equals population growth.

People see what I’ve seen each year for the past 11 years… this is the best quality of life in the US. Outdoor lifestyle and friendly people, along with foodie culture, great weather, and low taxes.

It’s hard to find the combination of elements that Austin offers. I meet people every week who are so excited to be here. I even have a tenant who moved here from South Africa!

I was in Australia last month, and when I told people I’m from Austin, I never once had to tell them what country or even state that is in. Usually, I get a, “Wow, I heard that’s the coolest city.”

This is no longer a lesser-known small city in middle America. It’s the yuppy global mecca.

In December, a new luxury highrise slated for Rainey Street started accepting contracts for units. Before they put the first stake in the ground, in five days they sold 300 units! Every unit under $5 million was swiped up, leaving only the penthouse units to buy.

The changing economics of Austin real estate will create a “Rent Forever” class of people who won’t ever be able to buy a home, but that’s a story for next time.

————————————

Special thanks to David Perell for helping me write this article.