Shapiro Real Estate Group Update | March 2021

Seems like the snowpocalypse was years ago…But, one of the prevailing signs of damage from the storm is the lifeless plants that we still see all around in Austin. If your plants are looking the same, I read it’s best to practice patience and hold off on pruning. And when the time comes to prune, be sure to take precautions—hire a professional or use the right tools and wear protective gear. For example, agave sap is toxic and will burn your skin on contact. Another tip when pruning agave: cut all the outer leaves, leaving the center leaves to grow out which will eventually cover the trimmed area. After trimming, the agave should initially look like a giant green pineapple! 🍍

Real Estate News

Buyer Fatigue is Setting In

With current inventory holding steady at about 70% less than what it was 12 months ago, we are still at crisis levels in Austin. Every home priced anywhere near range will sell quickly in this market. Although, it’s an experienced listing agent who puts the correct strategies in place and negotiates from strength that will ensure the highest possible price. 😉

After 5-10 offers and many failed attempts of getting a home under contract, some buyers are skimping out on what seems to be pretty minor things that can cost them their dream home (and some buyers are giving up entirely). And no it’s not always about the highest price—in fact, we were able to help our buyer secure a home even when their offer was $50,000 under other offers with some creative strategies. So don’t give up!

Austin Residential Housing Activity

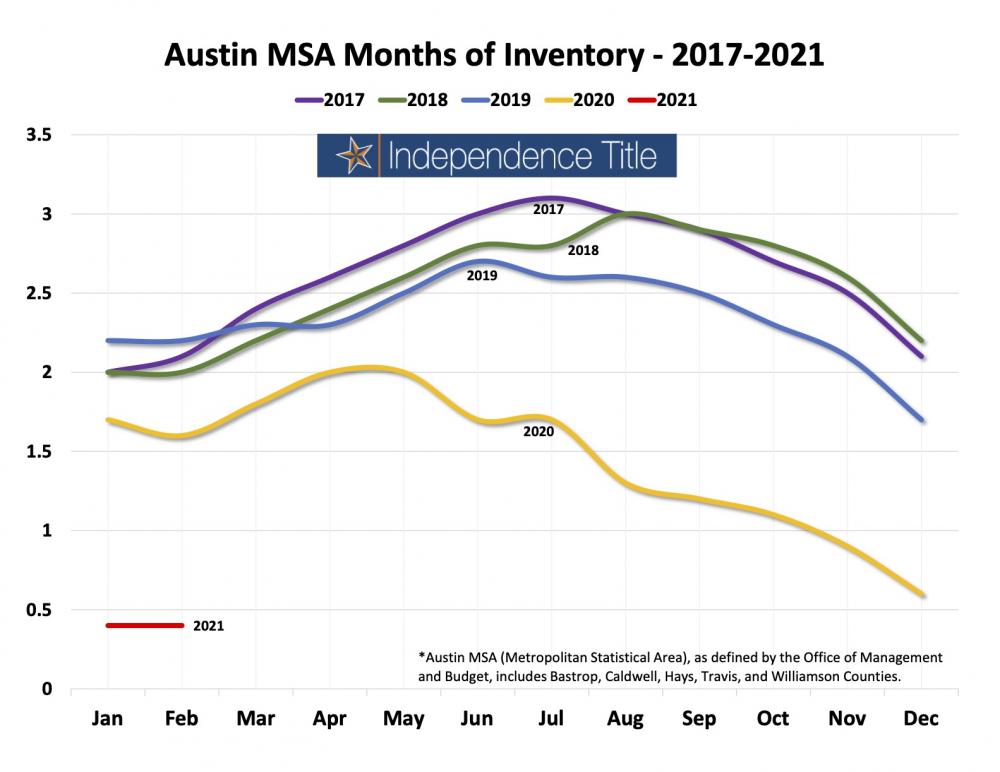

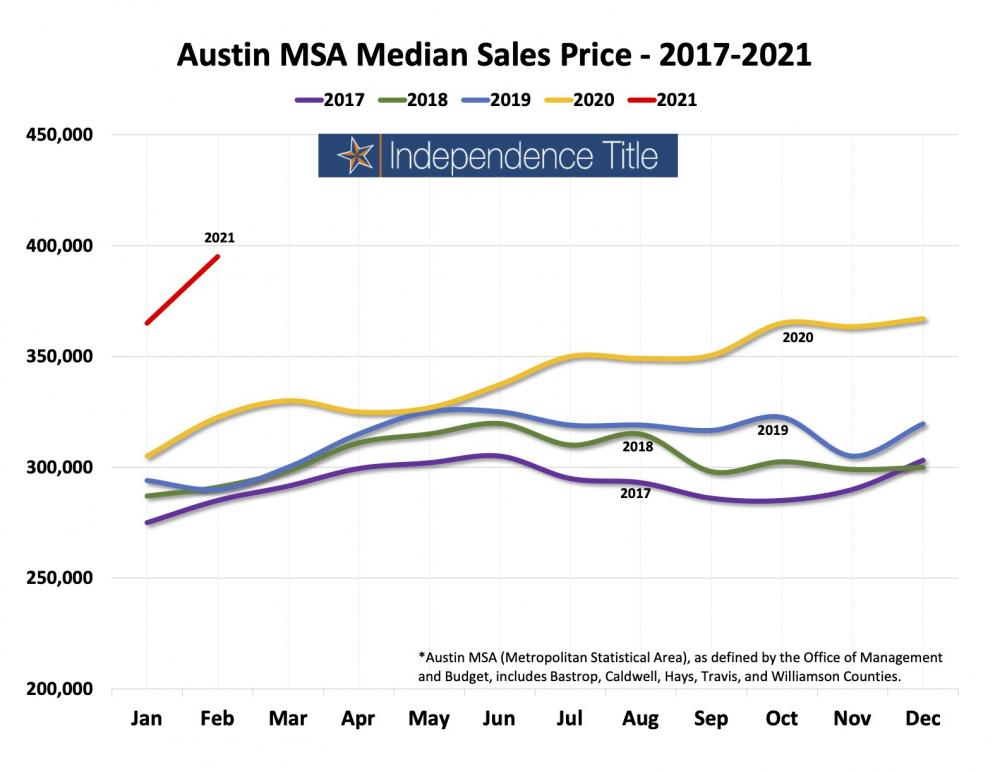

February ended with less than 2 weeks of inventory. The median sales price was around $400,000—that’s an 8% increase from just a month ago (for context, the average annual appreciation in Austin is 5.6%). Market sales comps are getting outdated in just a few short weeks and as I mentioned before, this decrease in inventory is not new—it’s a multi-year trend that Austin has been experiencing for the past 5 years.

So Where Is the Market Headed?

We may start to see a slight inventory increase as seller comfort levels rise to list their homes post-vaccination. More new construction homes may also become available as builder constraints ease with sawmills increasing their capacity to process lumber and more lots becoming available. Keep in mind that these are likely going to be pre-construction sales with 1-2 year delivery timelines and may not be close to Central Austin, which could be a huge benefit based on your specific goals.

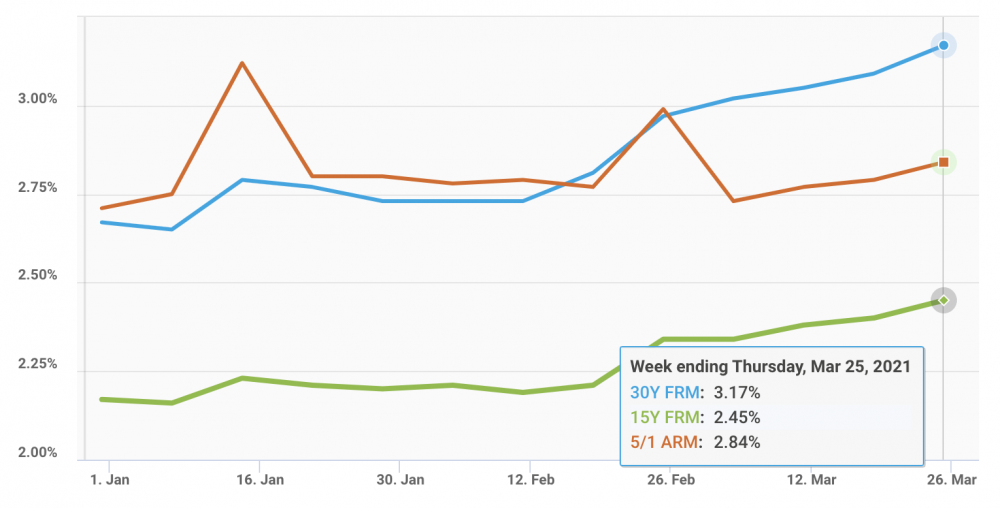

Since January, 30-year fixed-rate mortgage rates increased from 2.67% to 3.17%. This decreases buying power for those getting loans which is still the vast majority of home buyers. If you look at the chart below you’ll see we’re still at historic lows and this small increase won’t create enough pressure on its own to change the dynamics in the market.

For sellers, cash is king not because it nets you more money, but because there are fewer reasons the deal could fall apart. With prices appreciating so rapidly appraisals are not keeping up and cash buyers don’t have a lender requiring an appraisal. A buyer with financing can waive the appraisal if they have enough funds to make up the difference if the appraisal comes in low. Your agent can guide you through selecting the right offer based on your goals and strategize when and how to get you not only the best price, but the contract that is most likely to close.

For buyers, it’s important that you strategize with your agent and your lender now to see what options you have and how all these changes impact your buying power. Do you buy a home now? Or do you go under contract on a pre-construction opportunity that will allow you to lock down pricing and reap the benefits of continued and rapid appreciation in Austin?

For investors, less qualified buyers mean a strong rental market. This could be a good time for you to start your investment portfolio or grow your existing one.

For current landlords, for any leases coming up for renewal take a hard look at market rents because we’re anticipating a jump in rental rates so this could be a good opportunity to increase your return.

Mortgage Interest Rates

Lenders expect rates to increase throughout the year, but they should still remain relatively low compared to the past few years.

Property Spotlight

1812 E 6th St (6th & Chicon): Shovel-ready Project

.26 Acres | Multi-family Micro-unit Apartment Project | Offered at $6.9M

Who would buy this?

A developer, multi-family investor, or Hotel/STR operator who wants a project that will be stabilized in 2022 by saving the two years that it takes to get a site plan approved, which this project already has.

Located within the dynamic Plaza Saltillo Development Zone in Austin, Texas, the Project is a 60 “micro” unit apartment building, managed as a short-term rental asset, targeting an exit price of less than $400K/unit. It will be a newly constructed urban, luxury community, created with class A amenities and convenience. This well-appointed property rests in the vibrant and expanding East 6th Street development area.

With efficiency and sustainability in mind, the Project will be built using offsite building technology, significantly cutting the timeline to delivery, and reducing waste in the construction process. It will also be outfitted with Photo Voltaic (solar) panels as well as cutting-edge water-saving technologies.

The concept will focus around a multimodal transportation environment providing occupants with a choice of public transit, bike share, scooter, and ride share access to reduce or eliminate the need for single-occupancy vehicle trips by the residents.

Check out the prospectus to learn more.

Sustainability

Have you heard of Tree Equity? It’s a term coined by American Forests, the oldest national nonprofit conservation organization in the United States. Simply put, Tree Equity is about ensuring every neighborhood has enough trees so that every person can reap the benefits that trees have to offer. And I’m not just talking about environmental benefits that trees provide such as clean air and shade that can cool an area as much as 10 degrees which can help reduce heat-related illnesses and lower utility bills. Trees also help create good-paying jobs as they need to be planted and maintained!

But there are many ‘canopy gaps’ across America and they are most prevalent in socioeconomically disadvantaged neighborhoods and some neighborhoods of color. To help address this problem, American Forests developed Tree Equity Scores so local governments and community activists can use the data to build the case for planting trees in areas that need them most. “If your goal is health equity, if your goal is climate justice, this is a roadmap that is going to get you there,” said Jad Daley, American Forests’ president and CEO.

The Tree Equity Score Analyzer (TESA) is currently available for three pilot locations (Rhode Island, Maricopa County in Arizona, and San Francisco Bay Area). American Forests’ goal is to deliver Tree Equity Score to all 486 Census-defined urbanized areas in the country by 2022 which will tremendously help us combat climate change as well as socioeconomic inequalities. Want to help create a TESA in Austin? Join me and reach out to the American Forest team to find out how.