January 2026 – Newsletter

From what we’re seeing and talking to other agents, it feels like 2026 is off to a good start with new buyers entering the market daily, and if your home isn’t listed, you could be missing them. Sellers planning for 2026 don’t need to wait until spring, listing early ensures exposure to motivated buyers.

Austin Ranked #1 for Millennial Wealth

Austin–Round Rock–San Marcos was named the top metro for millennial wealth hotspots. Strong tech, education, lower rents, and family-friendly dynamics make Austin well-positioned for generational wealth transfer, attracting young professionals who fuel growth.

Market Snapshot

- Active Listings: Just over 2,100 active single-family listings in the city of Austin

- Pending Sales: 462 homes under contract in the past 30 days

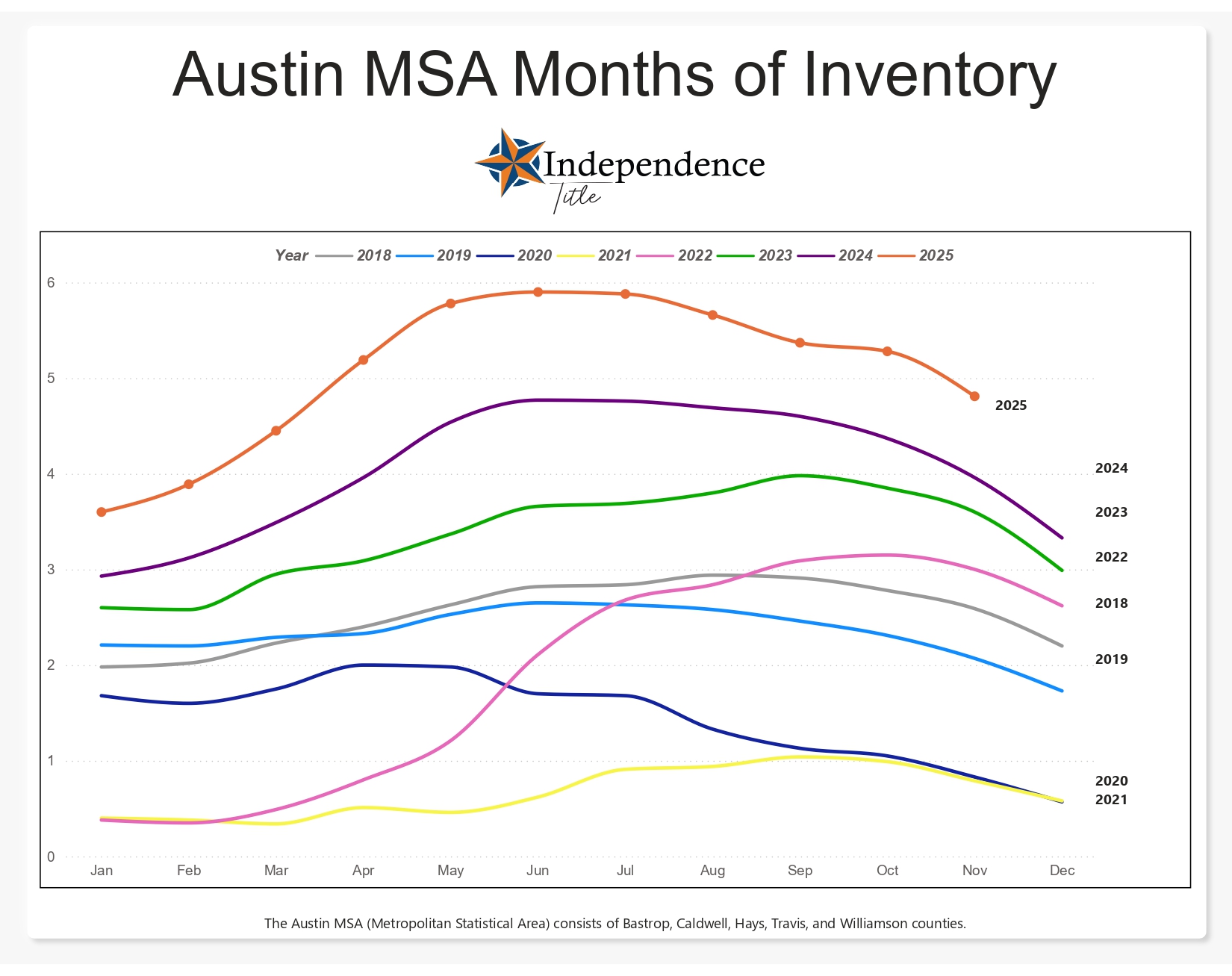

- Housing Inventory: 4.61 months of supply (still below the ~6–6.5 month “balanced” range)

Despite slower activity, low inventory keeps Austin tilted toward sellers. Well-priced homes, that are move-in ready are seeing strong offers, especially those in great school districts like Eanes ISD. If I were to distill an investment thesis for the next 5 years down to three words, it would be “Buy in Eanes”. This pairs well with those clients of ours that have young kids are starting to think about school districts.

There are 3,282 listings in Austin.

There are 119 listings that feed to Eanes schools 😮

\

\

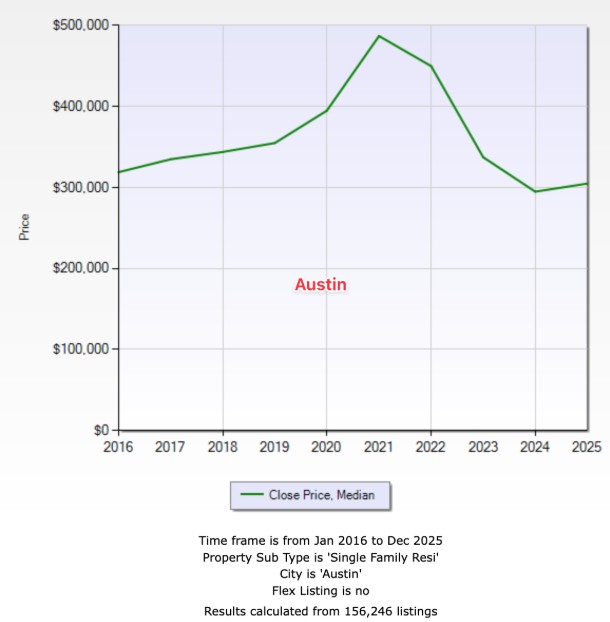

Now for City of Austin stats…

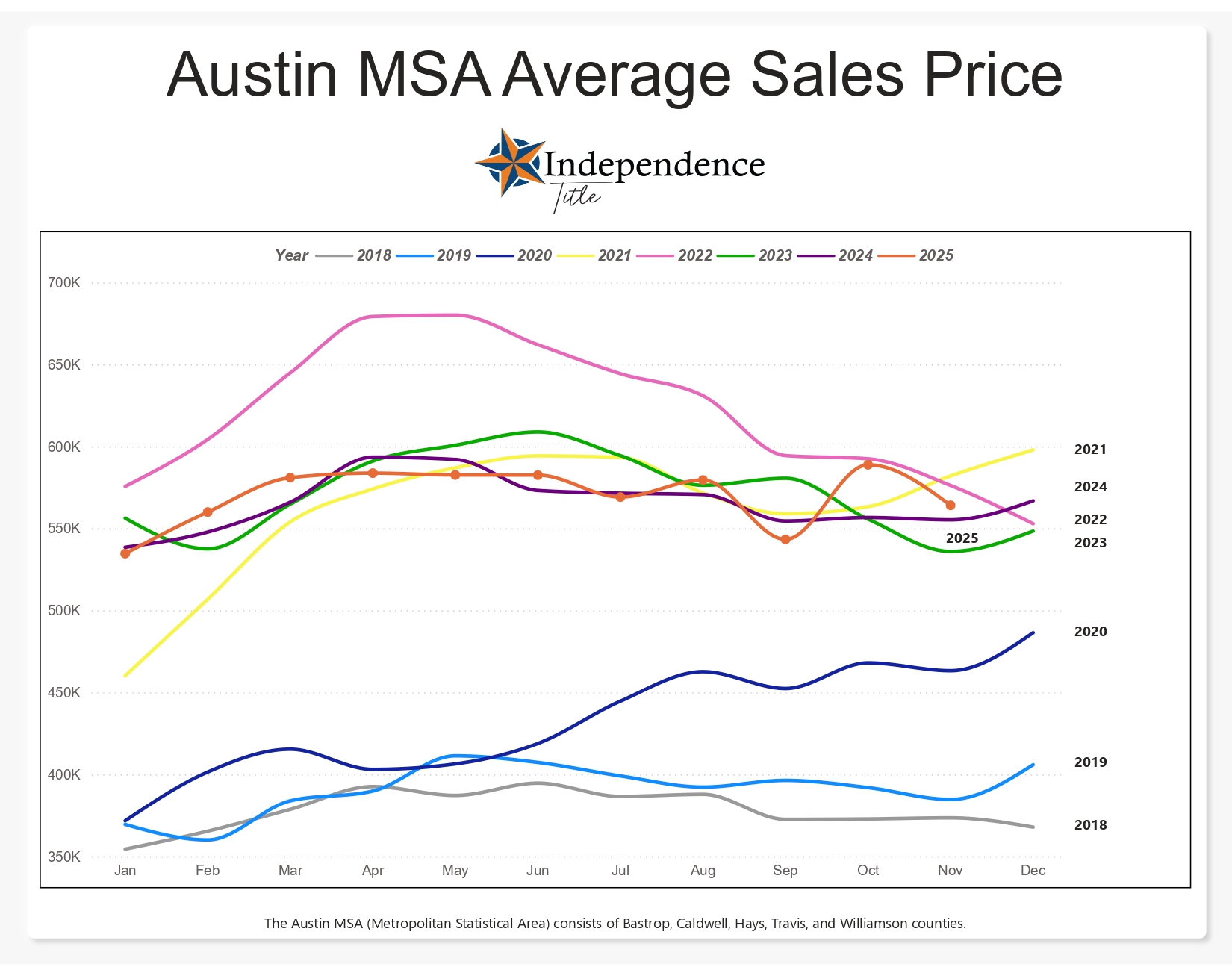

Pricing & Transactions

- Average Sale Price: ≈$821,000 in December

- Up from ≈$759K in November

- About 1.3% below the all-time high December 2024 number

- Closed Sales:711 in the past month, with both month-over-month and year-over-year counts up

- Days on Market:Still well above the boom years. Expect weeks to months, not days

Development & Affordability

Austin continues to build, with the HOME Initiative (three units per lot) gradually increasing density. Rents have decreased, improving affordability and attracting young talent, even if landlords feel the pinch.

Real-Time Market Pulse

Mortgage Rates

- Current 30-Year Fixed (Index): Around the 52-week low, 6.16% on the benchmark index

- Outlook / Actual Quotes:

- Many borrowers are being quoted 6% on 30-year fixed loan

- ARM products available in the low 5% range depending on profile and property

Looking Ahead

- Expect a January/February surge as buyers act on New Year’s resolutions

- Lower rates may ease the lock-in effect and drive activity

- Sellers: listing early in the year is key to capturing demand

Key Takeaways

- Inventory remains tight, favoring sellers with updated homes

- Prices dipped but remain stable long-term

- Pent-up demand and lower rates could spark a busy spring

Let’s talk about your goals whether buying, selling, or investing.

Call or text Lee at 512-969-2013

Wishing you a strong start to 2026—we look forward to sharing more insights as the year progresses. For more detailed analysis check out our most recent market update video…