Shapiro Real Estate Group Update | December 2020

Hard to believe, but the year is already almost over. I’m excited about 2021 and one of the things I will be focusing more on is sustainability (that’s my other passion besides real estate 💚). I feel immediate urgency to do more for our climate because according to climate researchers, 10 years is about the time we have to make key decisions and changes that will determine the future of the climate for centuries if not millennia to come. There are several ways we can contribute to reducing carbon emissions such as composting, growing a garden, or making conscious decisions to buy goods or use materials that have less impact on the environment. We can even choose to purchase properties that are built with materials that burn less fossil fuel. If we can work together to create enough demand for green buildings, that can become the standard and make it more affordable for the mass. If you are interested in learning more about building a zero-emissions future, check out this informative TED podcast—I learned so many interesting facts about soil! 😊

Another thing I am looking forward to in the new year is hopefully the end of the pandemic! I was excited to see three friends in healthcare get the vaccine. It felt a bit surreal thinking that the end is now in sight. Get ready—coming late 2021, Transformers 6 featuring yours truly as Optimus Hug…cause I’m gonna be a hugging machine! 😁

Real Estate News

Big Names Growing Office Space in Austin

Whole Foods and Facebook already have a big presence in Austin and they have plans to expand even more. Amazon-owned Whole Foods recently broke ground on a new five-story building that will be located across the street from their current headquarters. The new building will be an addition to the existing Shoal Creek Walk complex and will sit on top of the giant open concrete bed (y’all know what I’m talking about, right?). I’m really happy to hear this because that area looked unfinished! Those of you that walked past Shoal Creek Walk on W 5th and Bowie have probably wondered the same thing. As it turns out, the complex was originally developed with this addition in mind so things are making a lot more sense now! Here’s a rendering of the 143,800 sq ft office space with 127,104 sq ft of parking space. You can see the current Whole Foods office behind on the far left and the existing Shoal Creek Walk office building directly behind in the center.

Image Cred: Gensler Austin. Endeavor Real Estate Group, and Whole Foods Market

New Domain-like Development in South Austin

You know the shopping center with the Sprouts on S Lamar, near the intersection with Ben White/290 (4021 S Capital of Texas Highway)… it’s formally named Brodie Oaks Shopping Center and it originally opened in 1982. It may be redeveloped as a mix-use space similar to The Domain. Barshop & Oles Co, a commercial real estate developer, recently proposed an estimated $1 billion project that could convert the existing shopping center into as much as 3 million sq ft of office, residential, and retail space. The plan also included the addition of green space, a new trailhead, and public access area that would connect to the neighboring Barton Springs Greenbelt. If approved by the City of Austin, this development could completely transform the surrounding area and increase property value nearby. Full completion of the project could take up to 10 years and will likely be done in phases.

Image Cred: Lionheart Places, WP Visions LLC San Antonio

How Affordable is it to Become a Homeowner in Austin?

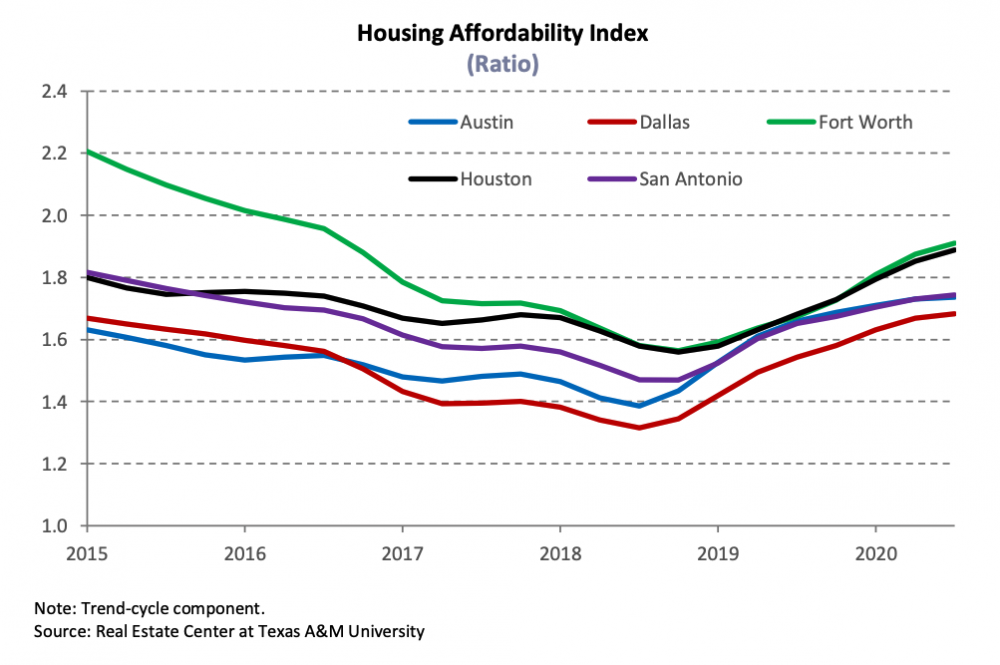

With the median sales price of homes increasing by 10% YoY to $433,493, there’s no getting around the fact that Austin is getting more expensive to live in. But if you look at the housing affordability index (HAI), Austin has become more affordable for median family income (MFI) home buyers since mid-2018 when the HAI was below 1.4. The HAI reflects the relationship between the MFI in a locale and the computed income required to purchase the median-priced home. The required income is derived from the current mortgage interest rate, the down payment, and the lender’s required mortgage debt-to-income ratio. An affordability index ratio of 1.0 indicates that the MFI is exactly sufficient to purchase the median-priced home. A ratio above 1.5 indicates the MFI is 50% more than the required income to purchase the median-priced home. And a ratio below 1.0 such as .8, indicates that MFI is 20% less than the required income to purchase the median-priced home.

Currently, Austin’s HAI is 1.7 indicating that the typical family income is about 70% percent above the income necessary to qualify for a median-priced home compared to 40% in 2018. The improvement in affordability is likely due to rising income and a decline in mortgage rates. Low-interest rates would have further improved housing affordability, but due to the current buyer demand and low inventory, housing affordability in Austin has remained flat throughout 2020. Another interesting fact is that Austin still remains to be more affordable for homebuyers than Dallas and is neck and neck with San Antonio.

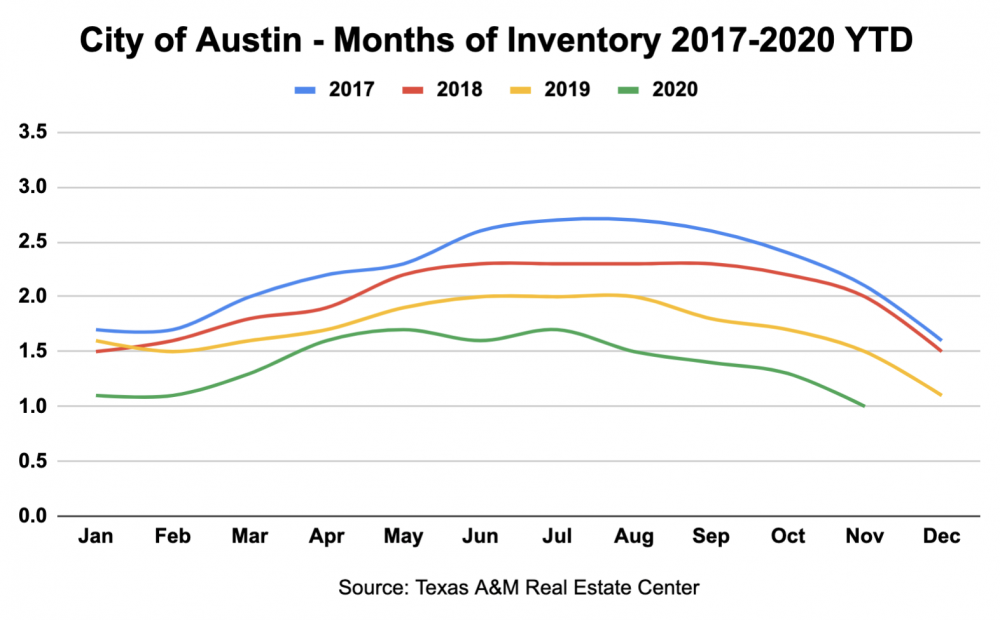

Austin Residential Housing Activity

Overall, the real estate activity in Austin has slowed down in November when compared to October. This is normal and expected during the holiday season. But when compared to 2019, the market has been stronger than ever. With inventory continuing to remain very low, I expect 2021 to be another strong year in the Austin real estate market! Check out the latest stats below.